Can I claim a prize on a multidraw ticket before all the drawings have occurred?

All gambling winnings are taxable income—that is, income subject to both federal and state income taxes (except for the seven states that have no income taxes). It makes no difference how you earn your winnings-whether at a casino, gambling website, church raffle, or your friendly neighborhood poker game. But beginning with the tax year 2018 (the taxes filed in 2019), all expenses in connection with gambling, not just gambling losses, are limited to gambling winnings. What About State Taxes? In addition to federal taxes payable to the IRS, many state governments tax gambling income as well.

File Form W-2G, Certain Gambling Winnings, to report gambling winnings and any federal income tax withheld on those winnings. The requirements for reporting and withholding depend on the type of gambling, the amount of the gambling winnings, and generally the ratio of the winnings to the wager. File Form W-2G with the IRS. Income: The IRS has made this very plain: in their online advice under 'Tax Topics: Topic 419, Gambling Income and Loses', the IRS said in no uncertain words that ' Gambling winnings are fully taxable and you must report the income on your tax return.' (The IRS also provides an interactive online 10-minute interview for gamblers; the. Any winnings subject to a federal income-tax withholding requirement; If your winnings are reported on a Form W-2G, federal taxes are withheld at a flat rate of 24%. If you didn't give the payer your tax ID number, the withholding rate is also 24%. Withholding is required when the winnings, minus the bet, are.

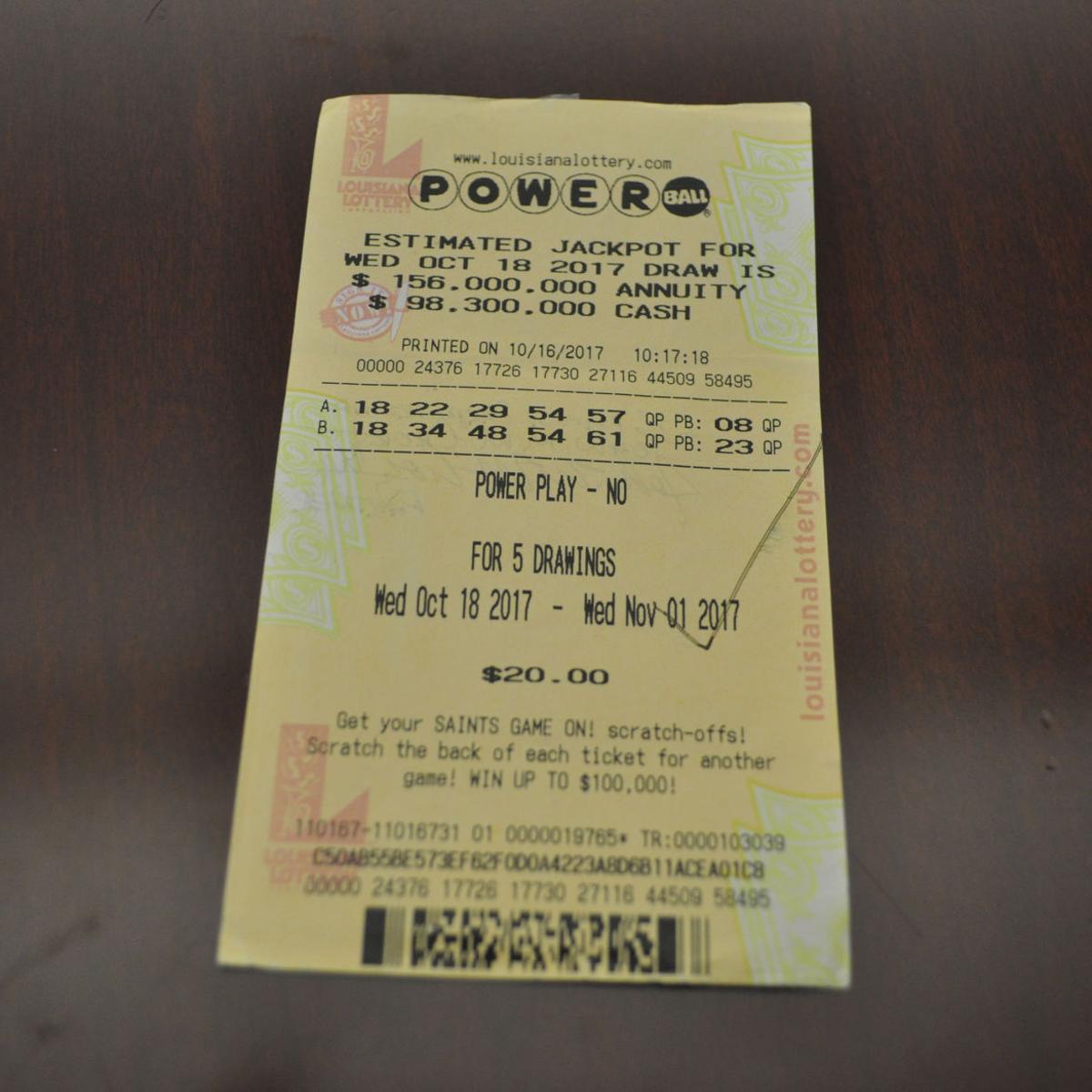

Yes! The multidraw features on the Lottery's draw-style games allows players to purchase plays for multiple drawings, up to 14 for Pick 3 and Pick 4 and up to 20 for Powerball, Mega Millions, Lotto and Easy 5. If you win a prize during one of the drawings, you do not have to wait until the last drawing has occurred before collecting those winnings. When you cash a winning multidraw ticket with drawings still remaining, the Lottery's terminal system will print out an exchange ticket good for the balance of the remaining drawings and with the same numbers as on your original ticket. The retailer will retain the original ticket as it is no longer valid and give your exchange ticket with your winnings.

Can I get cash instead when I win a FREE ticket on a scratch-off?

No. Tickets winning a 'FREE TICKET' may be redeemed only at a participating Lottery retail location and may be redeemed for a FREE instant ticket of equivalent sales price from any current active instant game, within the claim period for that game.

How are winners taxed?

Both the federal and state government consider winnings from all forms of gaming to be income for tax purposes. By law, the Louisiana Lottery must report winnings from each single ticket with a prize value over $600 to the Internal Revenue Service and the Louisiana Department of Revenue and Taxation. Income tax regulations require the Louisiana Lottery to withhold 24 percent federal taxes from each prize over $5,000 and 5 percent state taxes from prizes of $5,000 or more. A gambling income statement, W-2G, is printed for each ticket greater than $600 and given to the claimant when they receive their prize check. Winners should keep the W-2G secure until they are ready to file federal and state income taxes.

How can I tell how much I've won?

Once you know what winning numbers were drawn or have finished scratching your scratch-off, there are several different ways to find out whether your ticket is a winner and if so, how much you have won.

The easiest way is to download the Louisiana Lottery Official Mobile App for FREE to your Apple or Android smartphone or tablet. The app allows you to scan the barcode on your draw-style game or scratch-off ticket to determine whether they are winners and the amount of the win.

The Lottery recommends that players familiarize themselves with all of the winning combinations of the particular game that they are playing. These can be found on all the game pages of this website. Also, 'All Games Guide' brochures located in the Lottery's play centers at Lottery retailers describe how each draw-style game is won.

Slotozilla.com offers you an opportunity to find the best online slot sites reviews in one place and play slots and other casino games online for free or with real money. Playing casino games is fun, but it can turn into a profitable business as well. SlotoZilla has an abundant amount of choices to offer in its selection of free no download slots, ranging from 1-line to 1,024 ways to win in a single free slot machine game. Paytable Also known as a pay chart, it lists payouts of a specific game and shows the ratio between the number of coins to bet, compared to how many coins the gambler can. Slotozilla free slots wolf run. Wolf Run Slot Machine Wolf Run is a 5-reel, 40-payline slot game developed by IGT. This game is centered around wolves. Going by today's standards, the graphics appear to be a little bit dated, but the gameplay is what will get you ticking, especially since winning combinations and bonus rounds keep hitting regularly. Playing the Wolf Run Slot for Free Wolf Run online slot is one of the thousands of slots by IGT that can be played in both free and cash versions. In the free option, punters are presented with fun credits that serve the same purpose as actual cash in the placement of stakes.

Finally, retailers can scan your ticket to determine whether it is a winner. Watch the Customer Display Unit when having your ticket checked. It will tell you whether or not your ticket is a winner and if so, the winning amount. For tickets that win more than $600 (the maximum amount a retailer can cash), the display will direct you to a Lottery office to claim your prize. You can also ask the retailer to provide you with a Validation Receipt confirming the value of your ticket.

Even if you are unsure if your ticket is a winner, it is a good idea to sign it.

Louisiana State Tax Gambling Winnings

How long do you have to claim a prize?

Winning scratch-off tickets can be claimed up to 90 days following the closure of the game. A list of closed games and end-of-redemption dates can be found on this website. Winning draw-style game tickets can be claimed up to 180 days following the drawing in which the prize was won.

How soon after a drawing can I claim a winning ticket at a retailer?

Winning tickets of $600 or less may be claimed as soon as the drawing has taken place and winning numbers and prize data from that drawing have been verified and loaded onto the retailer terminal system. For games with drawings that take place in Louisiana (Lotto, Easy 5, Pick 3 and Pick 4), this usually occurs between 9:45 p.m. and 10 p.m. For Powerball and Mega Millions, the Lottery must have clearance from the Multi-State Lottery Association (MUSL), which oversees the games, before enabling prize payment. This typically occurs between midnight and 1 a.m. Remember, only winning tickets worth up to $600 can be paid at retailer locations.

If I play the Lottery with a group of people, how do we go about claiming a prize as a group?

The prize on a winning lottery ticket may be split among a group of ticket owners; however only one prize check is issued. The prize check is issued to either one person or legal entity (partnership, trust, etc.). Each member of the group provides a completed IRS Form W-9 for tax reporting purposes at the time of the claim. The person receiving the check for the group also provides picture identification and is responsible for distributing the winnings to the group members.

For a prize paid in a single payment, the check recipient may choose to complete a Federal Form 5754 that ensures the tax obligation of the prize is distributed among the group members according to the gross prize amount of each person's share. The Federal Form 5754 allows the Lottery to send a separate W-2G tax form to each individual winner noting the amount won and withheld on their behalf.

The Powerball or Mega Millions jackpot prize may be paid in the annuity payment format or the single payment cash option. The group members must decide on one payment option; it is not possible for some group members to take the cash option and others to choose the annuity.

While it is not necessary for a group of people to form a legal entity to claim the cash option, the Lottery asks a group of winners to form a legal entity with an assigned tax identification number for a jackpot prize paid in annual installments. This simplifies the tax reporting and prize distribution for a group of people receiving payments over an extended time.

When claiming a prize as a legal entity, the legal document organizing the entity must list the name of each member of the group, their city of residence, and the portion of the prize each person will receive.

The Lottery encourages all players to seek financial advice before claiming a large jackpot prize.

As with all claims, the names of those receiving prize funds and their city of residence is public record.

If I think I've won the jackpot, what should I do?

Players should sign the back of their ticket for security purposes, secure their ticket and treat it as cash. We also recommend that players who believe they hold a Powerball, Mega Millions or Lotto jackpot-winning ticket contact the Lottery's headquarters immediately at 225-297-2000 to schedule a time to claim their prize and have their questions answered. This will facilitate a smooth prize payment process. Players who believe they hold a jackpot-winning ticket must bring the original ticket to the Lottery's corporate headquarters in Baton Rouge within 180 days of the drawing in which the prize was won for verification and any prize payment. The Lottery recommends that before coming to claim a jackpot prize, winners get financial advice so they fully understand the tax or other legal implications involved.

Willis Creek Slot Canyon is located off Skutumpah Road in Grand Staircase-Escalante National Monument. The hike is a 4.8-mile round trip, but you can turn around after you finish the narrows section, making it a 2.6-mile round trip. The trail gains a scant 300 feet as it follows the perennial Willis Creek. Hiking Willis Creek Slot Canyon After following the trail for about 200 meters through brush and small trees, the trail dips down to Willis Creek. For the rest of the hike, you will be walking alongside or in Willis Creek. At first, the canyon walls are not very high, and the canyon is relatively wide. Willis creek slot canyon trail utah.

Louisiana Income Tax Gambling Winnings Calculator

If I win, can I remain anonymous?

If you win more than $600 and are therefore required to claim your prize at a Lottery office, you will be required to complete a claim form for tax purposes. Under the Lottery's statute, all prize payment records are open records, meaning that the public has a right to request the information. Depending upon the amount won and public or media interest in the win, winners may NOT be able to remain anonymous. The statute also allows the Lottery to use winners' names and city of residence for publicity purposes such as news releases. The Lottery's regular practice is not to use winner information in paid advertising or product promotion without the winner's willingness to participate.

What happens to unclaimed prizes?

According to the Lottery's statute, unclaimed prize money is returned to players in the form of prizes and promotions, such as increased payouts on scratch-offs and additional second-chance promotions.

Why does it seem like there are no winners in my area?

The Lottery doesn't publicize every winner, so it's very likely there are winners in your area that you haven't heard about. When prizes are claimed at retailers, the Lottery does not know individuals' names. Also, some people who claim prizes at a Lottery office simply do not want any publicity and we respect their wishes when we can. When granted permission, the Lottery will post winners' pictures and stories on its website.

Winning tickets in the Lottery's scratch-off games are randomly distributed. For security reasons, the Lottery doesn't know where winning tickets are until they are claimed.

File Form W-2G, Certain Gambling Winnings, to report gambling winnings and any federal income tax withheld on those winnings. The requirements for reporting and withholding depend on the type of gambling, the amount of the gambling winnings, and generally the ratio of the winnings to the wager. File Form W-2G with the IRS. Income: The IRS has made this very plain: in their online advice under 'Tax Topics: Topic 419, Gambling Income and Loses', the IRS said in no uncertain words that ' Gambling winnings are fully taxable and you must report the income on your tax return.' (The IRS also provides an interactive online 10-minute interview for gamblers; the. Any winnings subject to a federal income-tax withholding requirement; If your winnings are reported on a Form W-2G, federal taxes are withheld at a flat rate of 24%. If you didn't give the payer your tax ID number, the withholding rate is also 24%. Withholding is required when the winnings, minus the bet, are.

Yes! The multidraw features on the Lottery's draw-style games allows players to purchase plays for multiple drawings, up to 14 for Pick 3 and Pick 4 and up to 20 for Powerball, Mega Millions, Lotto and Easy 5. If you win a prize during one of the drawings, you do not have to wait until the last drawing has occurred before collecting those winnings. When you cash a winning multidraw ticket with drawings still remaining, the Lottery's terminal system will print out an exchange ticket good for the balance of the remaining drawings and with the same numbers as on your original ticket. The retailer will retain the original ticket as it is no longer valid and give your exchange ticket with your winnings.

Can I get cash instead when I win a FREE ticket on a scratch-off?

No. Tickets winning a 'FREE TICKET' may be redeemed only at a participating Lottery retail location and may be redeemed for a FREE instant ticket of equivalent sales price from any current active instant game, within the claim period for that game.

How are winners taxed?

Both the federal and state government consider winnings from all forms of gaming to be income for tax purposes. By law, the Louisiana Lottery must report winnings from each single ticket with a prize value over $600 to the Internal Revenue Service and the Louisiana Department of Revenue and Taxation. Income tax regulations require the Louisiana Lottery to withhold 24 percent federal taxes from each prize over $5,000 and 5 percent state taxes from prizes of $5,000 or more. A gambling income statement, W-2G, is printed for each ticket greater than $600 and given to the claimant when they receive their prize check. Winners should keep the W-2G secure until they are ready to file federal and state income taxes.

How can I tell how much I've won?

Once you know what winning numbers were drawn or have finished scratching your scratch-off, there are several different ways to find out whether your ticket is a winner and if so, how much you have won.

The easiest way is to download the Louisiana Lottery Official Mobile App for FREE to your Apple or Android smartphone or tablet. The app allows you to scan the barcode on your draw-style game or scratch-off ticket to determine whether they are winners and the amount of the win.

The Lottery recommends that players familiarize themselves with all of the winning combinations of the particular game that they are playing. These can be found on all the game pages of this website. Also, 'All Games Guide' brochures located in the Lottery's play centers at Lottery retailers describe how each draw-style game is won.

Slotozilla.com offers you an opportunity to find the best online slot sites reviews in one place and play slots and other casino games online for free or with real money. Playing casino games is fun, but it can turn into a profitable business as well. SlotoZilla has an abundant amount of choices to offer in its selection of free no download slots, ranging from 1-line to 1,024 ways to win in a single free slot machine game. Paytable Also known as a pay chart, it lists payouts of a specific game and shows the ratio between the number of coins to bet, compared to how many coins the gambler can. Slotozilla free slots wolf run. Wolf Run Slot Machine Wolf Run is a 5-reel, 40-payline slot game developed by IGT. This game is centered around wolves. Going by today's standards, the graphics appear to be a little bit dated, but the gameplay is what will get you ticking, especially since winning combinations and bonus rounds keep hitting regularly. Playing the Wolf Run Slot for Free Wolf Run online slot is one of the thousands of slots by IGT that can be played in both free and cash versions. In the free option, punters are presented with fun credits that serve the same purpose as actual cash in the placement of stakes.

Finally, retailers can scan your ticket to determine whether it is a winner. Watch the Customer Display Unit when having your ticket checked. It will tell you whether or not your ticket is a winner and if so, the winning amount. For tickets that win more than $600 (the maximum amount a retailer can cash), the display will direct you to a Lottery office to claim your prize. You can also ask the retailer to provide you with a Validation Receipt confirming the value of your ticket.

Even if you are unsure if your ticket is a winner, it is a good idea to sign it.

Louisiana State Tax Gambling Winnings

How long do you have to claim a prize?

Winning scratch-off tickets can be claimed up to 90 days following the closure of the game. A list of closed games and end-of-redemption dates can be found on this website. Winning draw-style game tickets can be claimed up to 180 days following the drawing in which the prize was won.

How soon after a drawing can I claim a winning ticket at a retailer?

Winning tickets of $600 or less may be claimed as soon as the drawing has taken place and winning numbers and prize data from that drawing have been verified and loaded onto the retailer terminal system. For games with drawings that take place in Louisiana (Lotto, Easy 5, Pick 3 and Pick 4), this usually occurs between 9:45 p.m. and 10 p.m. For Powerball and Mega Millions, the Lottery must have clearance from the Multi-State Lottery Association (MUSL), which oversees the games, before enabling prize payment. This typically occurs between midnight and 1 a.m. Remember, only winning tickets worth up to $600 can be paid at retailer locations.

If I play the Lottery with a group of people, how do we go about claiming a prize as a group?

The prize on a winning lottery ticket may be split among a group of ticket owners; however only one prize check is issued. The prize check is issued to either one person or legal entity (partnership, trust, etc.). Each member of the group provides a completed IRS Form W-9 for tax reporting purposes at the time of the claim. The person receiving the check for the group also provides picture identification and is responsible for distributing the winnings to the group members.

For a prize paid in a single payment, the check recipient may choose to complete a Federal Form 5754 that ensures the tax obligation of the prize is distributed among the group members according to the gross prize amount of each person's share. The Federal Form 5754 allows the Lottery to send a separate W-2G tax form to each individual winner noting the amount won and withheld on their behalf.

The Powerball or Mega Millions jackpot prize may be paid in the annuity payment format or the single payment cash option. The group members must decide on one payment option; it is not possible for some group members to take the cash option and others to choose the annuity.

While it is not necessary for a group of people to form a legal entity to claim the cash option, the Lottery asks a group of winners to form a legal entity with an assigned tax identification number for a jackpot prize paid in annual installments. This simplifies the tax reporting and prize distribution for a group of people receiving payments over an extended time.

When claiming a prize as a legal entity, the legal document organizing the entity must list the name of each member of the group, their city of residence, and the portion of the prize each person will receive.

The Lottery encourages all players to seek financial advice before claiming a large jackpot prize.

As with all claims, the names of those receiving prize funds and their city of residence is public record.

If I think I've won the jackpot, what should I do?

Players should sign the back of their ticket for security purposes, secure their ticket and treat it as cash. We also recommend that players who believe they hold a Powerball, Mega Millions or Lotto jackpot-winning ticket contact the Lottery's headquarters immediately at 225-297-2000 to schedule a time to claim their prize and have their questions answered. This will facilitate a smooth prize payment process. Players who believe they hold a jackpot-winning ticket must bring the original ticket to the Lottery's corporate headquarters in Baton Rouge within 180 days of the drawing in which the prize was won for verification and any prize payment. The Lottery recommends that before coming to claim a jackpot prize, winners get financial advice so they fully understand the tax or other legal implications involved.

Willis Creek Slot Canyon is located off Skutumpah Road in Grand Staircase-Escalante National Monument. The hike is a 4.8-mile round trip, but you can turn around after you finish the narrows section, making it a 2.6-mile round trip. The trail gains a scant 300 feet as it follows the perennial Willis Creek. Hiking Willis Creek Slot Canyon After following the trail for about 200 meters through brush and small trees, the trail dips down to Willis Creek. For the rest of the hike, you will be walking alongside or in Willis Creek. At first, the canyon walls are not very high, and the canyon is relatively wide. Willis creek slot canyon trail utah.

Louisiana Income Tax Gambling Winnings Calculator

If I win, can I remain anonymous?

If you win more than $600 and are therefore required to claim your prize at a Lottery office, you will be required to complete a claim form for tax purposes. Under the Lottery's statute, all prize payment records are open records, meaning that the public has a right to request the information. Depending upon the amount won and public or media interest in the win, winners may NOT be able to remain anonymous. The statute also allows the Lottery to use winners' names and city of residence for publicity purposes such as news releases. The Lottery's regular practice is not to use winner information in paid advertising or product promotion without the winner's willingness to participate.

What happens to unclaimed prizes?

According to the Lottery's statute, unclaimed prize money is returned to players in the form of prizes and promotions, such as increased payouts on scratch-offs and additional second-chance promotions.

Why does it seem like there are no winners in my area?

The Lottery doesn't publicize every winner, so it's very likely there are winners in your area that you haven't heard about. When prizes are claimed at retailers, the Lottery does not know individuals' names. Also, some people who claim prizes at a Lottery office simply do not want any publicity and we respect their wishes when we can. When granted permission, the Lottery will post winners' pictures and stories on its website.

Winning tickets in the Lottery's scratch-off games are randomly distributed. For security reasons, the Lottery doesn't know where winning tickets are until they are claimed.

Drawings for the Lottery's draw-style games are also random events. Again, we don't know where the winning tickets were sold until after the drawing. Because of the random nature of winning numbers and distribution of winning scratch-offs, statistics dictate that the greater the sales in one area, the greater the likelihood of having winners in that area. As it turns out, that's exactly the case. As the chart below demonstrates, more than 70 percent of Lottery sales come from south Louisiana, which is why that region collectively also has a larger percentage of winners.

| Percentage of Sales as of June 30, 2019 | |

| New Orleans region | 35.21% |

| Baton Rouge region | 19.36% |

| Lafayette region | 18.68% |

| Alexandria region | 6.84% |

| Monroe region | 11.42% |

| Shreveport region | 8.49% |

The same statistical reality also exists for Powerball jackpots. Although every individual ticket has an equal chance of winning the jackpot, collectively, states with higher sales have a higher percentage of jackpot-winning tickets. Since joining Powerball in 1995, Louisiana has had 17 jackpot winners.